Every now and then, I add companies to my Watchlist. These are companies that intrigue me enough to warrant further attention but do have a few drawbacks that deter me from purchasing them. As such, this post is not a recommendation to invest in the stock.

M1 Kliniken AG (M1)

Summary:

I like M1 for its exposure to the fast-growing aesthetics industry in Europe. Research indicates that individuals of all ages have begun to view cosmetic treatment as a tool to construct their social identity. Given this environment, the growth potential for this market is high though it remains fragmented globally, with the industry dominated by independent clinics.

Its growing competitive advantages in an untapped market at cheap valuations (~9x FY23 P/E) are additional positives.

However, its complex corporate structure, its large investment in a pharma trading business and limited financial disclosures are deterrents that keep me from investing in it currently.

What does M1 do?

M1, founded in 2012, is a German company that is the market leader in providing aesthetic medical treatments and cosmetic surgeries in Europe. The most common treatments are Botox, Fillers (Hyaluronic Acid) and surgeries such as breast augmentation.

The company operates ~43 beauty centres (under the Med Beauty brand) and 7 affiliated surgical clinics. Approximately ~75% of these are in Germany, with the rest primarily in Europe. From a total of ~50 clinics as of 9M2021, the company aims to double its network to ~100 by end-2024.

Ownership: M1 Kliniken is controlled (~69% stake) by MPH AG (ticker is 91M1 on XETRA), a listed Germany investment vehicle with numerous investments in the healthcare space.

Haemato acquisition: The company also has a 68% stake in Haemato AG (HAEK:XETRA) , which is a specialty pharmaceutical distributor. M1 Kliniken acquired this stake from MPH AG (M1’s parent) in 2020. This is essentially a B2B trading company, that imports drugs and resells to pharmacies, doctors and clinics across Germany and Austria. Haemato now also sells M1 Klinikens cosmetic brands via its network, and is aiming to launch its own Botox product over the next few years.

Split: ~60% of the gross profit, ~50% of EBIT comes from the aesthetic services segment, with the rest from Haemato AG.

Thus, buying M1 means that one is owning two businesses- an aesthetic clinic network and a B2B pharmaceutical trading company.

Strengths

Robust industry tailwinds: Cosmetic treatments used to involve surgery, which is usually expensive (a face-lift at ~$20k) and require time to heal (which means patients had to take leave from work to recover). With products such as Botox and Fillers, that dynamic has changed. Treatments are now ~$400-$1000 a session, are minimally invasive and require no recovery time. That has resulted in an explosion of popularity for these treatments, with the non-invasive cosmetic treatments industry expected to grow in the 12-15% range this decade.

Competitive advantages growing: M1 was an early first mover in the European market and has achieved strong economies of scale in its core markets like Germany. This, in turn, has led to them having a lower cost structure (due to the centralization of administrative functions) and more efficient processes (doctors can focus purely on treating patients). M1’s services are significantly cheaper than competitors, most of whom are independent clinics run by doctors and aestheticians. They also have other advantages, such as its own academy and a strong brand in its core markets.

Growth potential: The aesthetic treatment market remains fragmented globally, with the industry dominated by independent clinics. The number of listed peers remains small. Over the 2021-2025E, M1 is targeting a doubling of clinics, which works out to a ~19% CAGR. Additionally, M1 should see continuing improvement in unit economics, as it gains scale across its core European market and thus accrues cost-advantages in procurement and in spreading out its administrative costs.

Synergies between Haemato and M1: The company rationalizes the Haemato acquisition by highlighting two areas for synergies: 1) The ability for M1 to distribute M1 Select (an affordable cosmetics brand developed by M1) via Haemato’s broad network and 2) Haemato’s current initiative to bring its own low cost Botox product to market (Haemato is hopeful of doing this in 2025), that would result in large material cost savings to M1. It remains to be seen how these potential benefits play out - so far, investors are still not impressed with the Haemato acquisition.

M1’s stated advantages (from company)

Weaknesses:

Complex ownership structure with several large related party transactions: One of the main drawbacks to this company is the convoluted ownership structure, with M1 Kliniken having a controlling stake in another listed entity (Haemato). Investors rarely appreciate these kinds of moves, as it can lead to complex related party transactions, a lack of focus and inefficient decision making. Moreover, there have been key related party transactions recently - 1) M1 buying a stake in Haemato from its own parent MPH and 2) Haemato buying a 100% stake in M1 Aesthetics (the branded cosmetics business) from M1 Kliniken itself. While there is nothing to suggest that these transactions were done at the expense of minority shareholders, these kinds of situations often make investors wary, and raise the perceived risk of a stock.

Pharmacy Trading business a distraction: At the most fundamental level, investors who wish to invest in the medical aesthetics industry are unable to view M1 Kliniken as a pure play on the sector - given the large exposure M1 has to the pharmacy trading business. In general, the market tends to reward specialist pure-plays far higher in terms of multiples and tend to value conglomerates at a discount - as can be seen in M1 Kliniken’s fairly low market valuation to peers.

Limited disclosures: M1 Kliniken releases its financials on a half-yearly basis (although they did issue a press release at 9M2021), with limited disclosures on segmental details. The company needs to improve its Investor Relations disclosures, perhaps by creating a comprehensive slide deck, releasing more granular details around its business model and providing thorough segmental financials. Doing so would allow for both retail and institutional investors to better value the company on a sum of the parts basis.

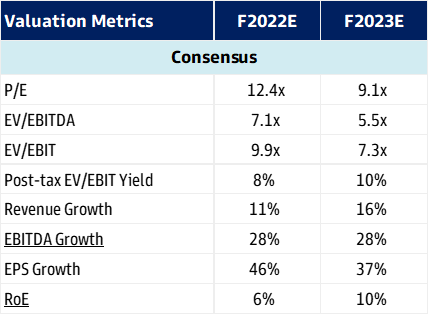

Mediocre return on equity: Despite strong growth in the next few years, projected ROE (consensus) is still in the 10% range.

Execution Risks: The company has several growth initiatives over the medium term, mainly 1) International expansion of its clinics and 2) Bringing its own botox product to market (under Haemato) by ~2025. While these strategies could yield significant benefits, they do have inherent risks.

Other risks: Medical aesthetics products like Botox and Hyaluronic Acid fillers are generally considered to be safe, but any shift in regulatory attitudes regarding the safety of these products would negatively impact M1’s business model. Haemato’s distribution business also operates in a highly competitive and regulated market, which could also influence its future profitability.

Valuations:

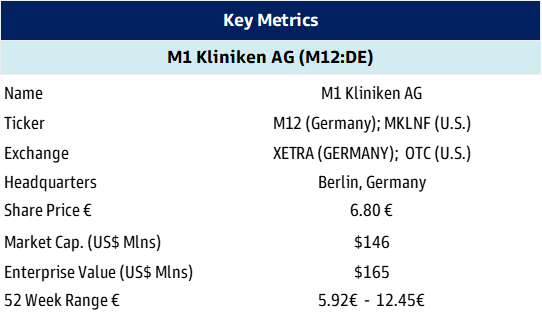

Valuations: Adjusted for the minority interest, valuations are ~5.5x EV/EBITDA, ~7.5x EV/EBIT. On a P/E basis, M1 currently trades at 9x F23 EPS - fairly cheap given the sizeable addressable market in the beauty business and the current growth rate (~16% rev. growth in F23E)

Sum of the Parts Valuation (SOTP): The SOTP is where it gets more interesting. I made some crude adjustments based on segmental profit disclosures and M1’s stake of 68% in Haemato. Even using conservative assumptions, I estimate that the core Beauty business will account for ~50% of FY23 EBIT and EPS. If I value the Haemato portion at 9x EPS (its existing multiple), the core beauty business trades at just ~9.5x - an extremely low multiple for a young growth business thats already profitable and growing at ~20% p.a….with a large addressable market to capture. Note that core Beauty segment excludes revenue from cosmetics brands purchased by Haemato from M1.

Consensus Valuations

Catalysts for the stock: I see several catalysts that could elevate the stock in the eyes of the investing community.

Simplification of corporate structure: Any transaction that simplifies the Haemato asset would be welcome news. This could be either be an outright sale (best case) to a third party. Alternatively, even a purchase of the remaining 32% interest would be preferable to the current ownership structure.

Progress on botox approval: Haemato is attempting to launch its own branded botox (in collaboration with another pharma company). This is a process that is expected to take years (certifications and trials need to be concluded). Positive updates on this initiative would be a boost to the stock, as it would not only drive Haemato sales, but substantially improve M1’s unit economics.

To conclude, M1 remains a company with strong prospects, albeit one with certain governance issues. I’d note that these issues are fairly common for younger small-cap stocks, and often get resolved as the company matures.

The company has growth potential along with improving competitive strengths, and is very attractively priced at ~9x P/E. If the management shows progress on improving the quality of its corporate structure and governance, I would, in all likelihood, add M1 to my portfolio.

Disclaimer: I am not a registered investment advisor. None of the above constitutes investment advice. Please consult your financial advisor and conduct your own research prior to investments. This publication is a journal documenting my investment experiences.

Great spot! Very interesting company, which I also came across when I was notified by my Insider Trading Tracker in January 2024 👇

https://rhinoinsight.substack.com/p/the-insider-report-012024)

I'll feature the link to this write-up in today's Friday Roundup.