Drone Delivery Canada ($FLT)

The next step in autonomous mobility

As a science fiction fan, I've always dreamed of a world with autonomous vehicles, flying cars, teleportation, floating farms, and hybrid robots everywhere. A world where science fiction and technology innovation collide and integrate, where the binaries between the epistemically possible and the logically impossible get blurred. Well, that future is now on the cusp of becoming reality.

Welcome to the first installment of my monthly analysis of the most promising young stocks on the financial horizon.

As an eagle-eyed investor – your goal, and mine, is to identify focus areas that are promising but are not yet in the spotlight, stocks that wait tentatively in the wings to be discovered. That elusive stock that hints at great things to come but has not stepped out into the limelight. Yet. You can sense it. But it isn’t all over the marquee. Yet.

My goal is to draw that one tantalising stock into the circle of light and analyse it threadbare. Give you the macro and micro picture.

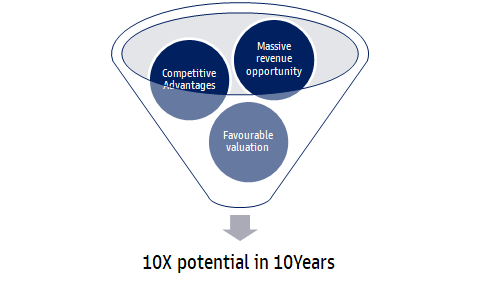

Be it stocks hitting unrealistic peaks and then crashing down to Earth on Fed policy, recent markets have been every bit as volatile as might be expected. When I consider the options on the table, what I am looking for are stocks with meaningful upside potential that have the capacity to grow exponentially over the coming decade without taking on undue risk.

To put it bluntly, stocks that have the potential to be worth 10x in the coming decade.

So to begin, I want to discuss one of my key holdings - Drone Delivery Canada (FLT- TSX Venture) - an emerging player in a paradigm-changing market, a transformative technology field that could top $100bln by 2030.

A note of caution: I would remind readers that FLT is a an early-stage pre-revenue company that is more suitable for investors with a high-risk tolerance and a long-term horizon. Like all startups, FLT carries a significant risk of failure.

What is FLT?

Drone Delivery Canada (FLT) is a technology company that designs and develops drone-based logistics systems for government and commercial customers. The company has a fully integrated hardware/software platform that it offers to clients on a Software as a Service (SaaS) business model.

It is the first federally licensed drone cargo operator in Canada and is in the midst of commercializing its full-service logistics platform. FLT was founded in 2014 and employs ~100 people.

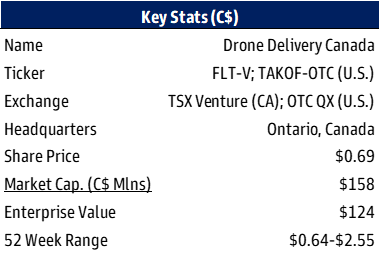

Key Stats:

Contents:

1. Investment Thesis

2. Background on Company & Industry

2.1. Timeline

2.2. Business Model

2.3. How it works

2.4. Industry

2.5. Management

3. Growth Drivers

4. Competitive Positioning – FLT’s advantages

5. Risks

6. Valuation –

6.1. Forecasts

6.2. Discounted Cash Flow analysis

6.3. Relative Valuation

7. Conclusion

8. Appendix

1. Investment Thesis: Why I own FLT

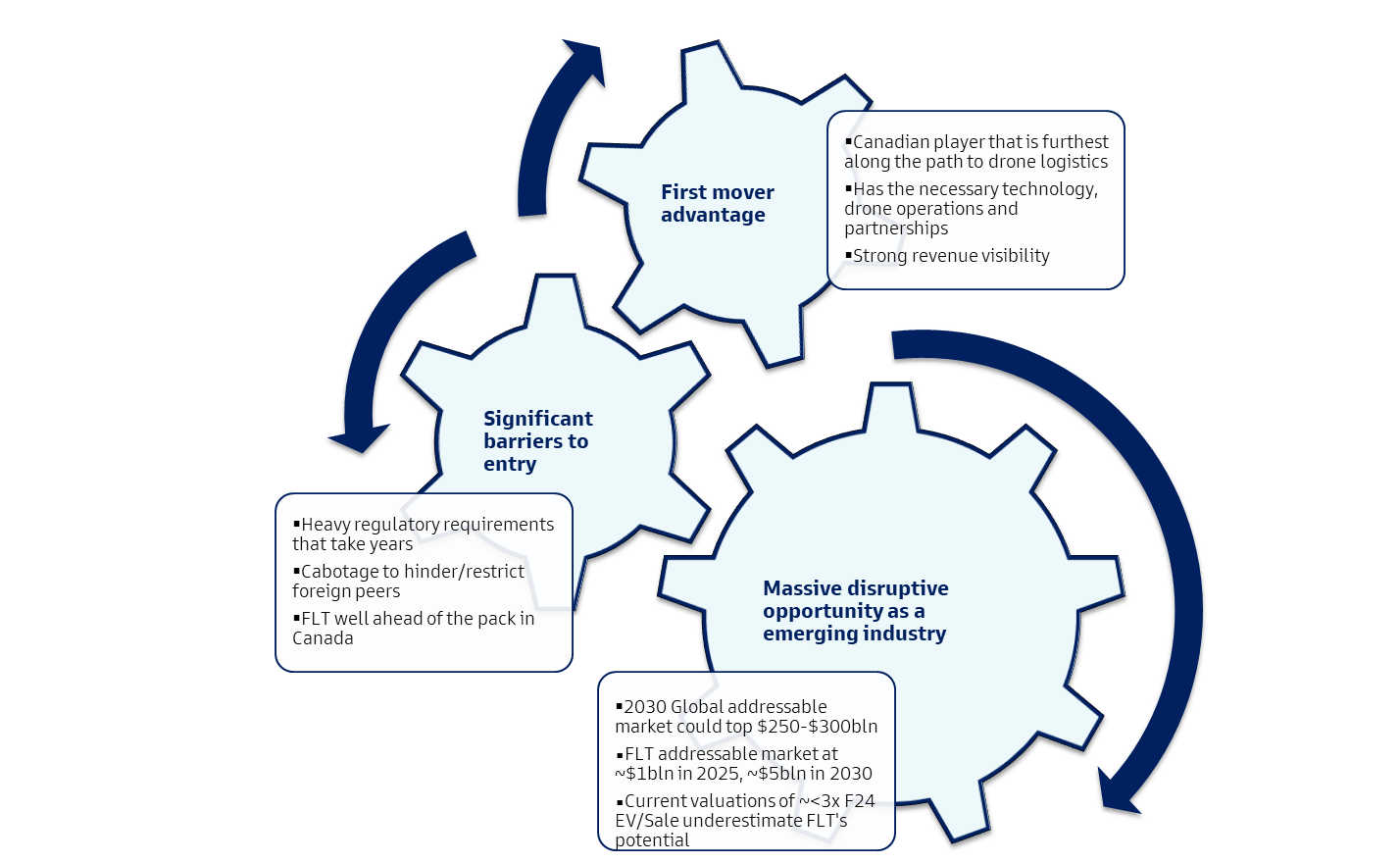

FLT's potential is based on industry drivers along with its unique competitive position within the drone market.

FLT represents an attractive long-term opportunity given:

1) The vast, disruptive potential of the drone industry to reshape logistics

2) Its first-mover advantage in a highly regulated industry

3) Its integrated logistics platform (software, hardware) makes it well-placed to scale up without requiring immense capital

4) Near-term revenue visibility (services to rural communities), tie-ups (Air Canada, Toyota), and adequate levels of funding (~2 Year runway) are additional positives

5) I see FLT as an emerging domestic leader in a nascent high potential industry (~$35b TAM by 2027) and believe current valuations ~(<3x F24 EV/Sales) and a ~$125m enterprise value make for a compelling high-risk/high-reward play

2. Background on Company & Industry

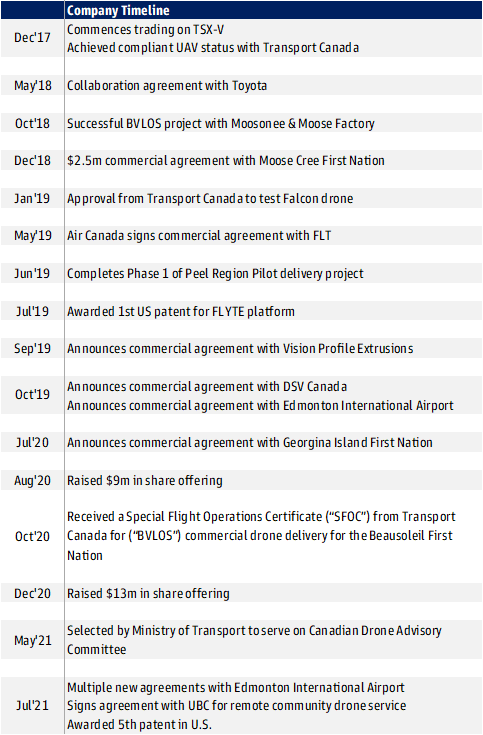

2.1 Timeline

FLT, founded in 2014, has created a software logistics platform for the remote operation of drones and is transitioning to its first year of commercialization.

2.2 Business model

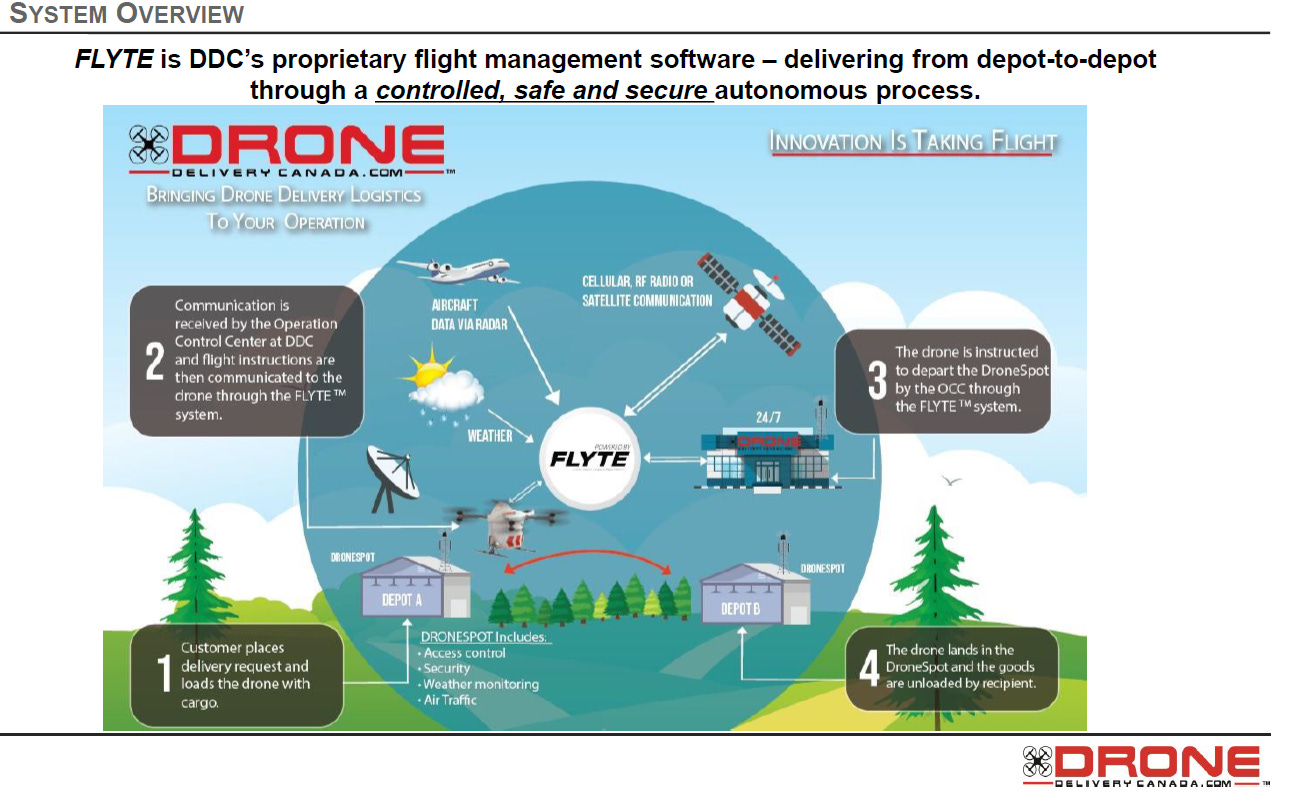

FLT’s platform is hardware agnostic and the company does not manufacture its own drones (they buy them from manufacturers). Instead, its focus has been on building its own software platform (“Flyte”), that can oversee the autonomous flights of these drones.

The company also has a flight control center that allows for landing and take-offs, and a team of flight controllers who can manually alter flight paths as needed.

The current business model is based around a fully integrated hardware/software drone logistics platform that it offers to clients on a Software as a Service (SaaS) business model.

Long term, FLT could also license its software platform to other logistics players or clients and charge commissions based on usage.

2.3 How it works - simplified

When evaluating a stock, I take a step back and break down the company’s operations into its bare bones. I ask myself questions - how does this business interest me as either an owner or a customer?

For example - What exactly does the company do? What do they offer to customers? What’s so special about it? Is there any value added to the customer?

So let’s answer these questions for FLT.

What FLT is offering to customers is, in essence - a cost-friendly, efficient way to transport goods in small quantities from A to Z.

Let’s look at FLT’s primary target market - rural communities in Canada. Many of these communities face exorbitant transportation costs for essential goods and services - due to their remote locations and adverse weather conditions. For example, if a town is running short of essential supplies at the same time as a winter storm - their only option is to commission a helicopter - at a very high price.

That is where drones come in. The cost of the drone is a fraction of the cost of a helicopter, so even if it gets damaged, it is not a significant loss. More importantly, there is no human life at risk (unlike a pilot or a truck driver being stranded). So a drone could quickly be commissioned to transport smaller items like medicines or food to small towns.

Similarly, for a manufacturer which operates multiple factories and warehouses across a large region, there are often times when critical components need to be transported to an operational site. For example, the factory may be running low on supplies of screws or batteries, which could be critical to the overall production process. Instead of commissioning a truck on an emergency basis to make the delivery (which would be expensive), the company could turn to drones instead, cutting down on costs and time in the process.

Lastly, having the optionality of a drone service network also reduces risks in the supply chain. In the event of a natural disaster or even a pandemic (as we have just seen), drones represent a way to transport essential equipment without the need for human contact, bolstering the resilience of an enterprise.

To summarise, these are the areas of value-addition to customers

Servicing hard to access locations

Time-critical deliveries

Disaster recovery/Business continuity

2.4 Industry background and Total Addressable Market (TAM)

2.4.1 Industry background

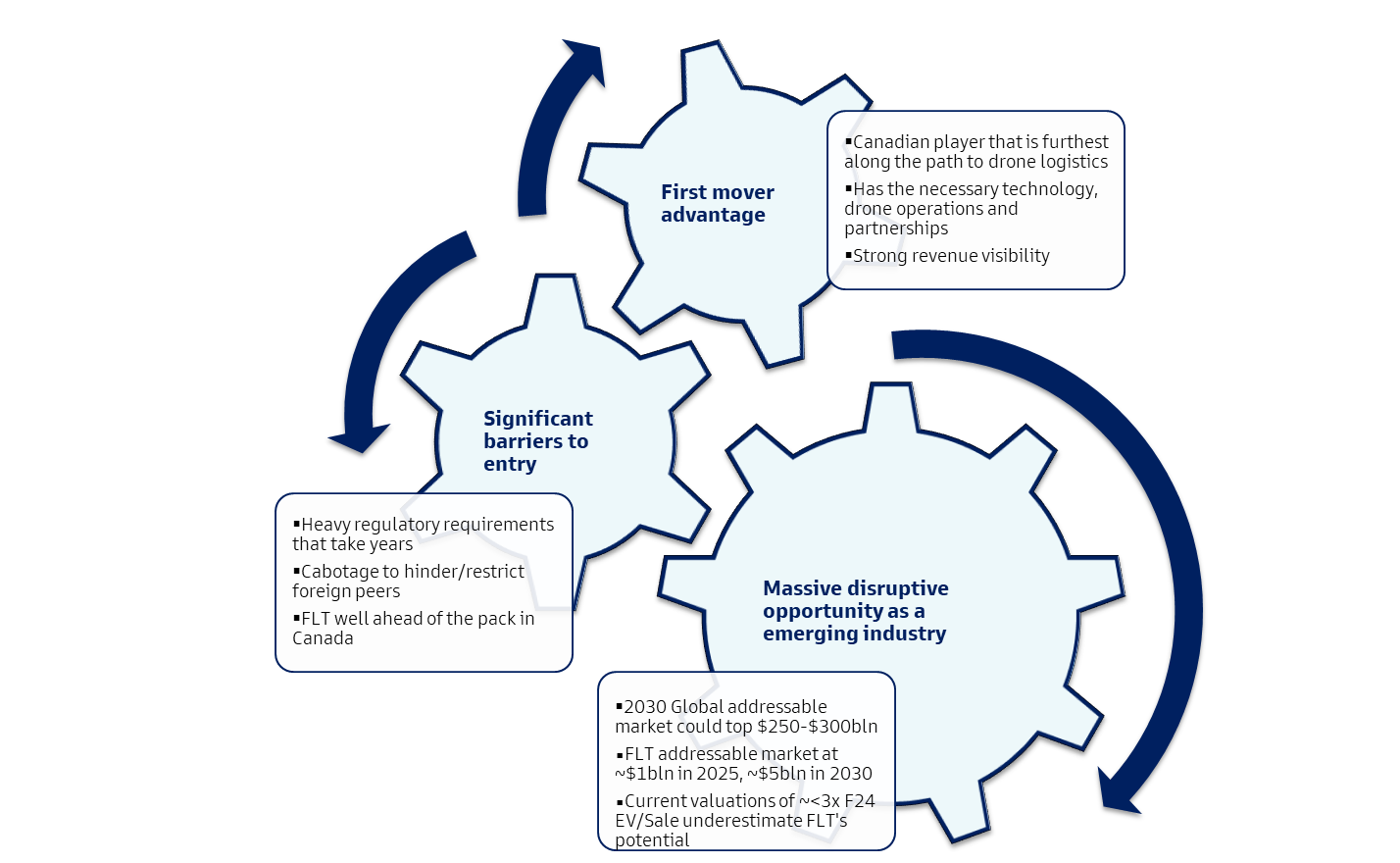

With nascent technologies like this, the industry tends to play a large role in the company’s success. The early movers, in particular, have the potential to reap the largest benefits - but only if they are able to convert their first-mover status into a competitive moat.

The industry for drone services is vast, with numerous practical applications. These include transport of cargo (Depot to Consumer -D2C and Depot to Depot – D2D), surveillance/inspection (of oil rigs, facilities, infrastructure, etc.), media (videography), medical emergency aid and warfare (weaponry), among others.

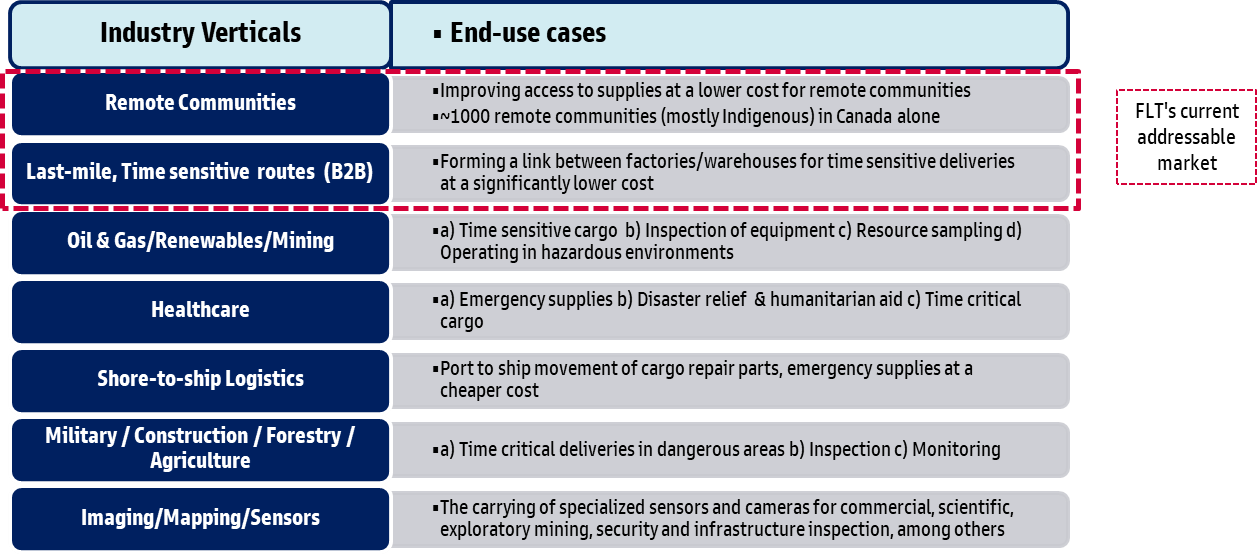

Currently, FLT is focused on the logistics opportunity within the Remote Communities and B2B logistics space, where they can offer time sensitive deliveries of critical goods/components at a much cheaper price. These two segments currently hold the most potential for the drone logistics industry, as the value proposition is strongest - existing solutions are far more expensive and/or time consuming.

2.4.2 Estimating FLT’s TAM

Sizing the Remote Communities opportunity: FLT’s contract with the Moose Cree community was for ~$2.5m/year. According to the company, there are ~1000 remote communities that could require similar services. FLT believes the industry penetration could touch ~20% by ~2025, which would yield a market opportunity of $500m. Now, I do not believe that the industry will attain $500m in 2025 revenues from this segment (my FLT segment revenue estimate for 2025 is ~$60m), but the underlying logic makes sense. Even if the number of rural communities who need drones is lower than 200, there are plenty of opportunities for increased usage/revenue per year (more routes, upsizing of services, direct to consumer logistics) that could be realized over time.

Sizing B2B deliveries: Estimating the TAM for B2B drone logistics is far more challenging, as the segment is vast, and the number of routes that drones could serve is dependent on various factors such as 1) Cost savings 2) Number of time-critical deliveries required 3) Distances traveled. The overall market for transportation in Canada is ~$90b, of which trucking accounts for 50% or ~$45b (based on StatCan GDP estimates). I estimate that by 2025 drones can service ~1000-1500 routes for business customers across Canada, with an average annual revenue for each route at ~$150,000 -$200,000 (based on FLT estimates), taking our 2025 segment TAM estimate to a range of $150m-$300m. Our revenue estimate for 2025E is a modest ~$13m for FLT.

Licensing: FLT’s aims to license its proprietary software platform “Flyte” (which is drone hardware agnostic) to other logistics operators around the world. The model would work like this - A logistics provider/airline/cargo operator in a foreign market would approach FLT to use its software platform in exchange for a license fee. The key question is - Why would they pay FLT? Well, there are three likely reasons - 1) Lack of software know-how 2) The cost of a license would be cheaper than internally building the software and 3) The risks in the business are high- so licensing a software platform that is approved by Canadian regulators and has a proven track record can be seen as a lower risk option. The key challenge for FLT however, is that in the licensing space, the company would potentially be competing with giant competitors like Google, Amazon along with several well-funded start-ups. For these reasons, I don’t see this segment becoming a key driver for the company. However, FLT is still likely to generate modest revenue in specific niches over time. The TAM in this segment would be enormous ($20b+ by 2030), but I have modest expectations for FLT here. My 2025 revenue estimate includes $10m in licensing revenue (15% of revenues). While this segment would be small in revenue terms, it would carry very high margins given the lack of incremental costs involved.

Overall, for FLT’s core target markets, the 2025 revenue opportunity ex-licensing works out to ~$600m-$1b. By 2030, with drones continuing to prove their value proposition, this could work out to a ~$3b-5b target market. Further, this doesn’t include adjacent markets such as B2C deliveries, or other industrial tasks such as monitoring, inspection etc. For comparison, our FLT revenue estimates for 2025E/2030E are a modest ~$80m/$360m, respectively.

2.5 Company Management & Shareholding

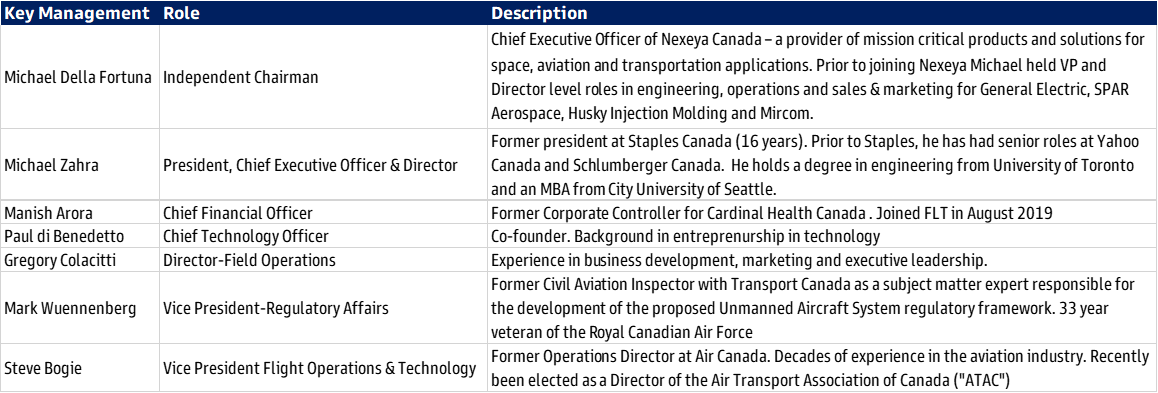

The company was co-founded by two brothers - Tony and Paul Di Benedetto - in 2014. Tony was the former CEO until he transitioned to a non-executive role (currently on advisory board). Paul Di Benedetto is currently an engineering strategist. The two of them formerly ran Millenium Data Systems - a wireless services company. They also founded Data Centres Canada, which was acquired by Terago Networks in 2013.

The company is currently led by Michael Zahra (appointed CEO in Dec’2018), a former president at Staples Canada (16 years of work experience at Stapes). Prior to Staples, he has had senior roles at Yahoo Canada and Schlumberger Canada.

Overall, the company’s management seems broadly competent, with top management possessing solid credentials and experience in the technology, transportation and engineering space. Of course, that’s not a guarantee of success, but seeing veterans in the field does provide some reassurance on execution (which is the key for FLT). The appointment of veterans from the air transport and regulation space, in particular, is a positive.

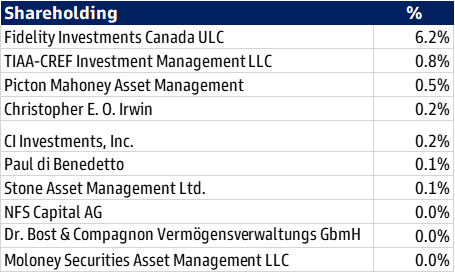

On the other hand, insiders own a miniscule amount of FLT shares - top management own <1% of shares outstanding - a low % for an early-stage technology company. I would also note that the stake of the co-founders (no longer classified as insiders) seems to have reduced over time.

3. Growth Drivers:

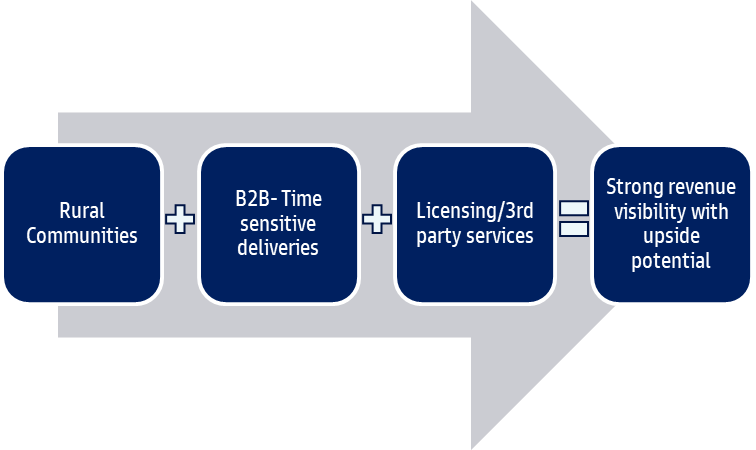

Within this broader drone space, FLT is choosing to specialize in logistics. Areas of focus are

a) Serving remote communities (such as First Nation communities in Canada) where the cost of emergency supplies is prohibitively high.

b) Time-critical deliveries for business customers - for example - helping to move supplies between manufacturing or warehousing units.

c) Licensing: FLT is also exploring licensing its technology and FLYTE software platform to international clients as a way of global expansion.

Remote communities: For FLT, the key near-term market is servicing rural communities in Canada. There exist ~1,000 such communities in the country that currently receive goods via expensive forms of transport like helicopters. Ensuring these communities get adequate supplies is a priority for the federal government, which has several programs to subsidize logistics costs. FLT currently has contracts to provide services to the Georgina Island First Nation, the Moose Cree First Nation and the Stellat’en First Nation (via the University of British Columbia).

Time-critical B2B deliveries: The key opportunity for drones in the logistics segment is aiding companies to transport cargo across their supply chain. Drones, with their small cargo capacity and flexible operation, can help transport small components of limited quantities on an ad-hoc basis to minimize supply disruptions. For example, in the event of a shortage of a small component/product at a specific factory/warehouse, a firm could turn to a drone service for efficient and timely delivery, instead of altering its complex logistics schedule.

Current commercial contracts: FLT signed a long-term contract with Air Canada in June 2019, through which the airline would offer FLT’s services to its customers in exchange for a commission on revenue. The company has existing contracts with the University of British Colombia, Edmonton International Airport, DSV Air & Sea, GlobalMedic and Vision Profile, partly driven by the Air Canada agreement.

Long-term opportunity: Licensing: FLT’s growth potential is centered on the Canadian market, where it has a first-mover advantage in cargo transport and is partially protected by foreign investment restrictions. Long term, however, FLT could license its “Flyte” software to competitors/logistics players internationally, and perhaps also manage the operations for a third-party. This could include logistics providers, cargo jet operators, trucking firms etc., who could use drone delivery as a complement to their existing offerings without needing to develop the technology itself. Of course, these opportunities would involve competing with large and better-funded competitors like Google Wings, Amazon, Zipline, Flirtey, Avitas (a subsidiary of G.E), and hence, we do not incorporate any revenue from this segment in our estimates.

Long-term opportunity: Direct to Consumer deliveries: This is not an area FLT is currently targeting and with good reason. There are considerable challenges to remotely operating a drone in residential areas, namely:

a) Public safety (what if a drone crashes?)

b) Technological: Targeting residential areas requires far less room for error in terms of mapping accuracy, sensor capabilities etc.

c) Social backlash (do people want a million drones dotting their skylines?)

d) Logistical challenges - Where do the drones land? How do they avoid critical infrastructure?

That being said, as the industry grows over the long term, attention will inevitably shift to disrupting the residential delivery market. After all, imagine ordering a pizza and seeing a drone deliver it in your backyard in 30 minutes!

4. Competitive positioning: Why $FLT? Why can’t competitors do the same?

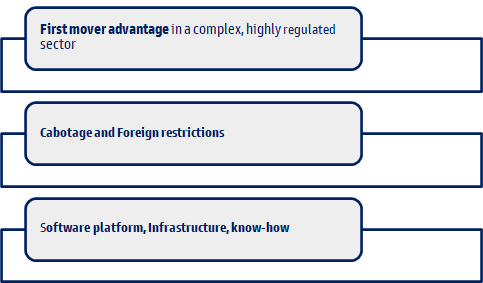

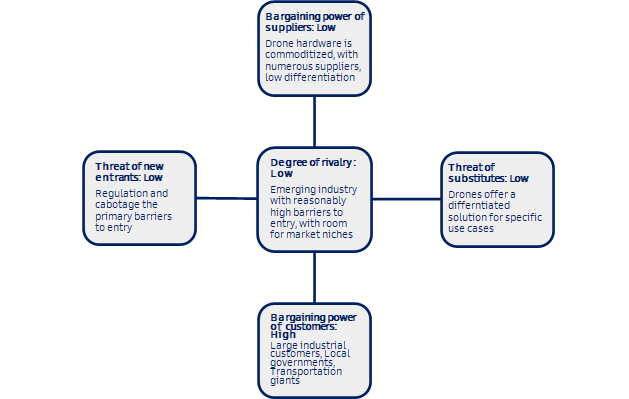

First mover advantage in a complex, highly regulated sector: One of the key competitive advantages that FLT has over its competitors is that it is the furthest along in terms of getting approvals from the Government of Canada. As far back as 2018, FLT was one of four companies invited by the Canadian government to create concepts for BVLOS operations in Canada (the others being Canada Post and two other drone infrastructure/mapping firms). Additionally, in July 2021, they were the first publicly traded drone company to get a domestic cargo license from the Canadian Transportation Agency.

Cabotage and Foreign restrictions: Similar to regulatory restrictions in the Air Transport industry, it is expected that Canadian regulations will prevent/restrict foreign competition in drone operations. Cabotage, the carriage of domestic traffic by a foreign carrier, is also prohibited in Canada and as such, foreign couriers such as UPS, FedEx and DHL, will likely rely on Canadian operators, such as FLT, to transport cargo across Canada. Foreign ownership restrictions (currently at 49% limit for airlines) could also act as additional barriers. Overall, it is likely that FLT could enjoy a more favourable competitive landscape, especially given its early head-start.

Software platform, Infrastructure, know-how: FLYTE is FLT’s software offering that underpins the company’s drone network. It offers features such as scheduling routes and maintenance, tracking flights and monitoring operations. FLT has several patents already with the United States Patent Office (with additional ones pending approval). Through its software, FLT can manage and monitor its drones from a centralized command centre, meaning that FLT can operate the drones remotely. FLT’s new 16,000 sq. ft. operational facility, which was completed in 2019, houses its mission control center capable of hosting 25+ drone operators. Overall, a new competitor would need to invest significant resources and require specialized know-how to catch up to FLT. While large technology players could attain this capability, it would probably be easier to partner with or acquire FLT to save time and resources. Thus, FLT’s software platform and expertise does give it a modest advantage.

Industry Competitive forces - a favorable backdrop

5. Risks

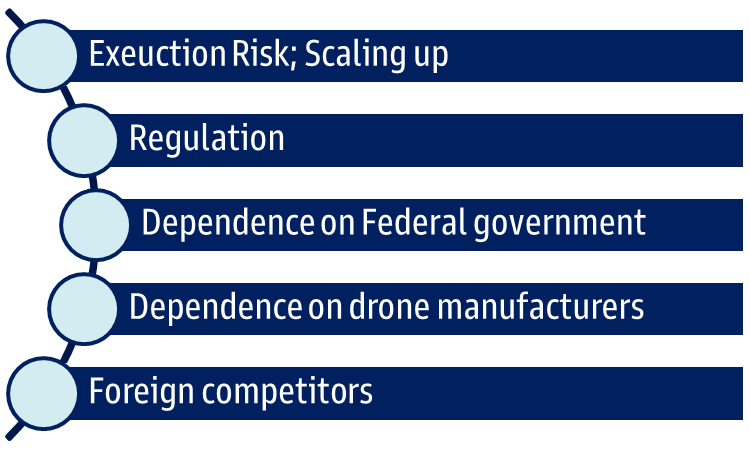

Execution and scale-up: Despite having setup the initial framework for a drone delivery network, there are still challenges involved in successfully monetizing its technology and services. The company needs to execute on its early pilot projects, convince customers of the value-add potential and continuously improve its offering. Remember, this is essentially a start-up. So it does carry a higher degree of risk than an established company.

Regulation: Much of FLT’s progress will depend on the actions of Canadian regulators. Drone regulators require licenses to operate, and public safety remains one of the primary concerns. A major accident involving a drone could add further restrictions on drone operations and set FLT back.

Federal government support: The Canadian federal government currently subsidizes delivery of essential/emergency supplies to rural communities (First Nations). While FLT’s offering has the potential to drive these logistics costs lower, these projects will still depend on federal government support. As such, changes in budget allocations etc. in the future could impact FLT’s revenue.

Dependence on manufacturers: FLT sources its drone hardware from established drone manufacturers, some of whom are based in China. In the event of deteriorating relations between Canada and China, there could be tariffs/export bans that impede FLT’s ability to source drones.

Foreign competitors: If the Canadian government were to significantly relax regulations in this sector, one could see large U.S. competitors like Google, Amazon, Zipline etc. enter this market, making it more difficult for FLT to dominate its market. However, I do still believe that FLT’s first mover advantage and status as an “independent” Canadian firm would allow it to have a meaningful market-share in this scenario. Further, in this scenario, it might be more attractive for a large foreign player to partner with or acquire FLT as a way of rapidly scaling up in Canada.

6. Valuation

Valuing an early-stage venture is exceedingly challenging, with the output in a DCF model highly sensitive to underlying assumptions. Therefore, I think it’s important to also compare FLT’s valuation to similar small-cap growth stocks.

6.1. Forecasts: Expect ~$80m in revenues by 2025`

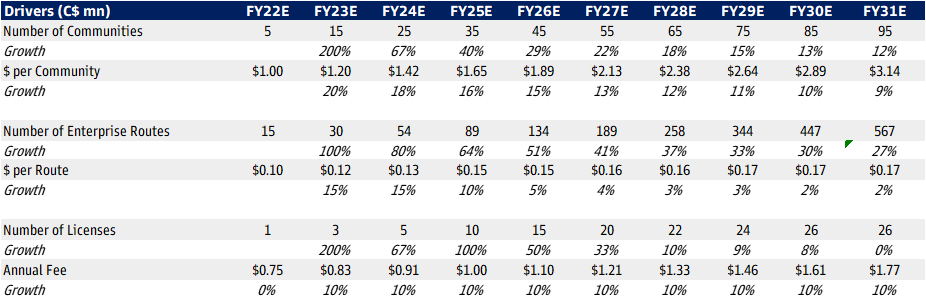

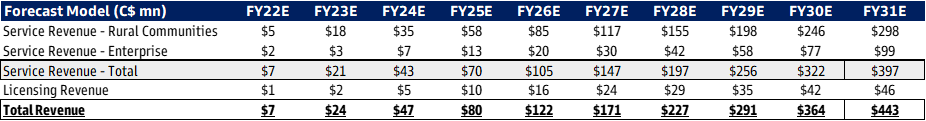

We expect FLT’s revenues to expand from a forecast $7m in 2022E to ~$80m by 2025. We estimate the largest source of revenues to come from contracts with industrial enterprise customers, with service revenues from rural communities following. Licensing revenues are a longer-term driver, and will take time to scale up. However, they are likely to be very high-margin, due to the low incremental costs associated with it. As such, they provide a strong boost to FLT’s overall profitability.

Revenue drivers

6.2 DCF assumptions and output

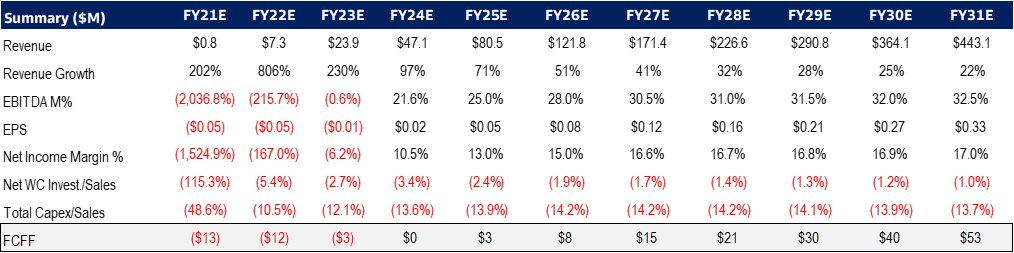

I estimate ~25-30% EBITDA margins over the next 5 years, well below company guidance of 35%. As FLT develops its pilot hubs and scales the number of routes it runs, it should see the benefit of operating leverage.

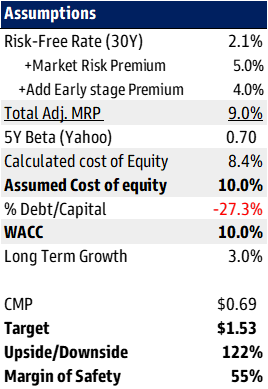

Based on a cost of equity of 10%, the DCF yields a target price of ~$1.50 or roughly 100% upside relative to current levels. That being said, DCF models for early-stage entities are highly sensitive to the assumptions used in the model.

6.3 Multiples and Relative Valuation

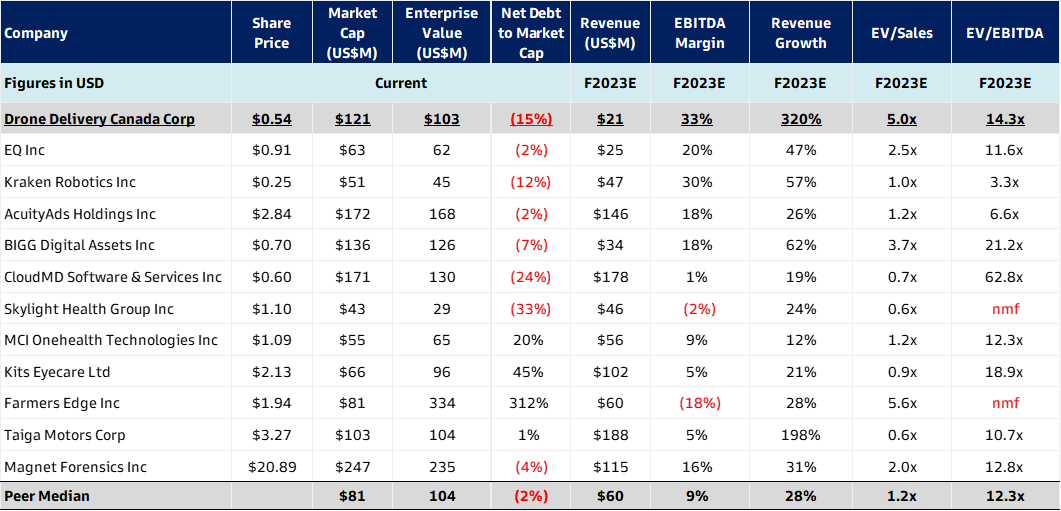

Compared to growth stocks in the Canadian marketplace, FLT trades at a premium in some respects, partly due to it being a more early-stage company than other names. However, the consensus numbers below still provide a favorable view on FLT, with robust growth expectations and strong margins.

Given these factors, we think F2023 ~5x EV/Sales (on what is likely to still be a low base) is reasonable given the long term growth potential and stronger profitability potential.

Relative Valuation (Consensus)

7. Conclusion

I firmly believe that the drone industry is a sunrise industry that will eventually reshape the way modern logistics is performed, cutting down the time required for deliveries while simultaneously lowering costs.

Undoubtedly, challenges remain - public safety, the integration of drones within city infrastructure and the slow pace of government regulations are all key barriers. However, in time, these will get resolved.

If FLT can successfully execute on its growth plans, there is a high possibility of the market starting to value the company for its enormous growth runway, with multiples like 10x EV/Sales (currently <3x on 2024E) not out of the question. Early-stage companies with far weaker fundamentals trade at richer multiples. A 3x return in 2 years is not out of the question. Building on that, I foresee a return of 10x in 10 years is entirely possible with strong execution. On the downside, if FLT sees increased competition or its services see slower adoption than expected, I could see the stock heading to $0.30-0.40 levels or a ~50% loss. The company still has north of ~$30m in cash on hand. With an average burn rate of ~$2-3m a quarter, this should give them a solid 2 years to survive absent any revenue - which offers some security over the medium term.

Overall, I view FLT as a compelling risk-reward play, with enormous upside due to industry drivers, its competitive positioning and its first-mover advantage.

Disclaimer: I am not a registered investment advisor. None of the above constitutes investment advice. Please consult your financial advisor and conduct your own research prior to investments. This publication is a journal documenting my investment experiences. I own the security FLT (TSXV).

Appendix

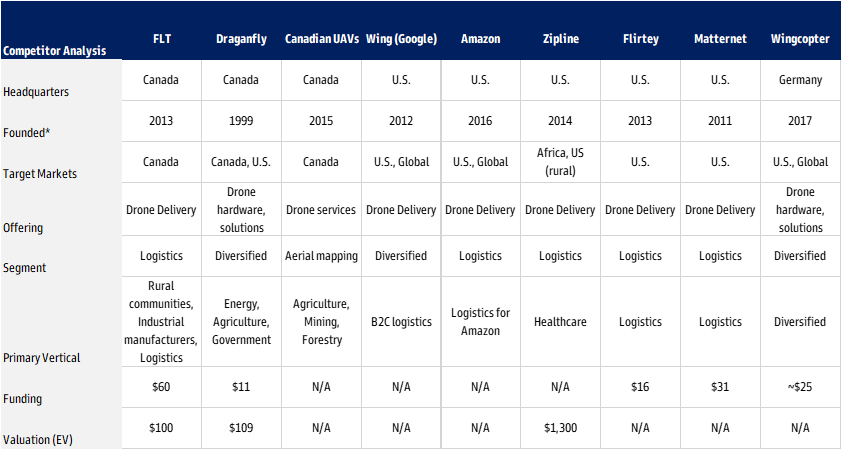

Competitive Landscape

Peer comparison

Currently, there are few listed peers for FLT - most are privately funded. Let’s take a look at the overall competition by geography.

Canadian competitors:

Canadian UAVs: A drone service company that specializes in areal mapping solutions for sectors like agriculture, mining and forestry. They do not offer logistics solutions, and as such, don’t compete with FLT.

Draganfly: A more diversified player that offers various solutions to the energy, agriculture and government sectors. Not into logistics or goods delivery.

US competitors: The list of US competitors is numerous, headlined by Big Tech and VC-funded startups with plenty of firepower. Most focus primarily on the US market and some international markets (but not Canada).

Amazon: Has its own drone division called Amazon Prime Air, that is aimed at delivering small packages up to a range of 15miles. The long terms goals are to support Amazon’s E-commerce business via last-mile delivery.

Google Wing: The subsidiary is named Wing. Focuses on small packages, and uses a tether to drop items to recipients. 100K flights made so far. Unclear as to what the ultimate goal and synergies are for Google. The end game for Google here could be on the software side - developing a software platform for drones that have synergies with Google’s consumer platforms as well as its business offerings (such as cloud).

Zipline: US company focusing on delivering health care supplies to rural areas. Primary operations in Rwanda, Ghana and the U.S. Valued at $1.2 in last funding round (May 2019).

Flirtey: U.S. company that is focusing on delivery of packages - similar target markets as FLT, but in the U.S. only so far. Relatively small - only ~$17m raised so far.

Others: Firms outside the US market include Wingcopter (delivery drone company, founded in Germany), Matternet (CA-based).